REPORTING DIRECTLY TO THE CREDIT BUREAUS

Most small affordable housing providers are not equipped to report directly to the credit bureaus without a significant investment of time, resources, and understanding of the compliance requirements. If you want to report directly to the bureaus you need to allocate staff time for the initial set up, capacity within your IT department, and a firm understanding of the Fair Credit Reporting Act (FCRA). In addition, each bureau has their own set up process. The process may take many months. Every credit bureau has its own specific credentialing requirements and criteria. A Property Management Company (PMC) or landlord should understand the risks associated with an application to and set up with the credit bureaus. There is no guarantee that the PMC or landlord will be successful in such efforts.

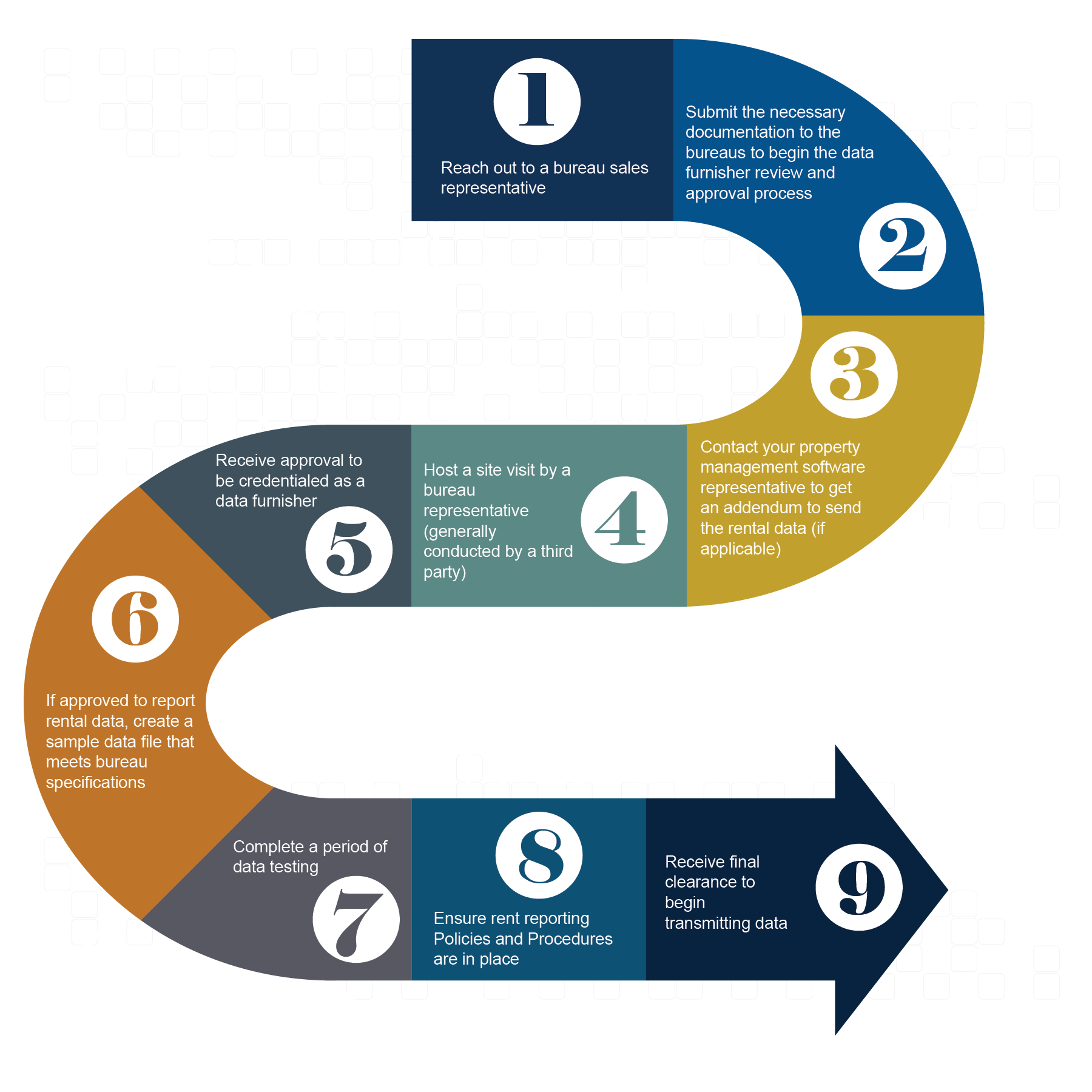

The general steps required by the bureaus to set up include:

Other considerations:

Compliance: Reporting directly to the credit bureaus means that you are solely responsible for complying with the FCRA. At the core of the FCRA is the requirement that, among others, data furnishers submit data with accuracy and integrity, manage disputes in an ongoing and timely manner, maintain up-to-date data furnishing policies and procedures, and more. You can learn more about FCRA compliance from the Federal Trade Commission site here.

Data Formatting: Data sent to the credit bureaus should be formatted into a standard electronic data reporting format called Metro 2®. This is not a format that typical property management software are set up for, but some may have a module that you can add on (likely for a cost) that will translate rental data into Metro 2® Format for credit reporting. For more information on Metro 2® visit CDIA here.

Staff capacity: First, you will need dedicated staff to lead your agency through the bureau credentialing process. This can be time intensive. Next, you will need a staff person who is fluent in your property management software and in most cases willing to become versed in Metro 2® format. Next you will need someone tasked with ongoing monitoring to ensure the data is received by the credit bureaus and showing up correctly on residents’ credit reports.