Mitigating the Potential Risks of Rent Reporting

When talking about rent reporting, we often get asked, what’s the hitch? In this post we break down the ways in which rent reporting could potentially damage a renters credit profile and how to mitigate this risk.

Rent reporting is an evidence-based strategy with clear benefits to the average renter. While it’s among the lowest risk ways to build credit, there are still potential associated risks, and not every renter is a good fit for rent reporting. Since most affordable housing providers offer rent reporting as an opt-in program (residents must choose to participate) the risks can be mitigated through renter education- providing renters with the right information so they know if participation makes sense for them- and by choosing a rent reporting option that best meets the needs of housing providers and their residents. Below are some key points about potential risk to renters:

Rent Reporting may not lead to improvement across all credit profiles

Everyone’s credit profile is different. Rent reporting is a powerful strategy to help those with little to no credit scores become scorable, and those with low credit scores, but minimal delinquent debt boost their score. For residents struggling to pay their bills, including rent, and/or who carry high-debt loads, or have multiple recent items going to collections, participating in rent reporting may further aggravate their hardships.1 In this case, supporting the resident to become financially stable before they elect to enroll in rent reporting will mitigate any further impact to their credit report. In addition, renters that already have multiple active lines of credit may not experience much impact from rent reporting.

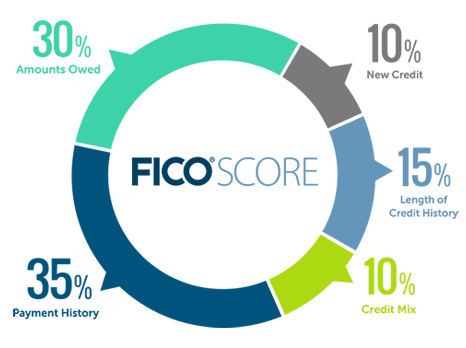

While a late payment could potentially lower a renter’s credit score, rental payments are only considered late by the credit bureaus if they are over 30 days past due

Payment history is the most influential factor in a credit score calculation. As with other types of credit accounts, late rental payments may damage a resident’s credit score if the housing provider is reporting positive and negative payments to the bureaus (see more on this below). However, missed rental payments cannot be reported as delinquencies on the credit report until they are at least 30 days past due. During this window, housing providers typically have a series of interventions and communications to try to get the renter current on their rent. This 30-day timeframe gives the renter time to catch up or agree upon an alternative repayment agreement so that their rental payment can be reported to the credit bureaus as on time.

Most affordable housing agencies offer residents the opportunity to disenroll from rent reporting at any time

If a resident’s circumstance has changed and they can’t pay rent on time or are merely not interested in participating, they can disenroll from rent reporting at any time. Rental payment data furnishers are also required to notify residents if their payments are about to be reported as late. We encourage these notifications to include messaging about disenrollment so that in the case a negative payment is reported, it only happens once.

Some credit bureaus and third-party rental servicer companies only report positive payments

Housing providers can eliminate the risk of late reporting by being selective about which credit bureaus they report to OR by selecting a third-party provider that only reports positive-only payments to the credit bureaus:

- Among the three main consumer reporting agencies, Equifax and Transunion add both negative and positive rental payment information on a consumer credit report. Experian filters rental payment data through its Experian RentBureau. Only positive rental payments then show up on the Experian consumer credit report (and “no data” is reported for late or missed payments). While only positive rental payment information will show up on an Experian consumer credit report, positive and negative rental payment information may show up on other types of reports (ie tenant screening) that Experian offers.

- Third party rental servicers that act as data furnishers to the credit bureaus may choose to just report positive rental payment information. In CBA’s Rental Servicer Directory, users can sort by companies that report positive-only data and those that report both positive and negative data.

In cases where the resident is not paying rent for legal reasons, housing providers should have procedures in place to eliminate negative reporting repercussions

In cases where a resident is withholding rent to assert their rights (for example for a home repair, etc.) this should be documented and reporting of rental payment data should be suspended as well. If a resident in the late stages of eviction and the housing provider is no longer legally able to collect rent from the resident, rent reporting participation should also be terminated. However, in both of these cases it’s best to consult legal counsel when developing rent reporting policies and procedures. Last, it’s important to note that residents always have the right to dispute anything that they believe to be inaccurate on their credit report, including rental payment history.

Housing providers have long reported negative payment information to the credit bureaus. What’s new is that by offering rent reporting, they now have the chance to report positive information. By being mindful of the factors listed above, housing providers can set up a rent reporting program that, with the right communications and interventions, will pose minimal risk to their residents.